The global semiconductor market has become a battleground not only for technological advancement but also for geopolitical tensions. As nations grapple with the implications of chip production and its interconnectedness to national security, the enforcement of stringent regulations has emerged as a necessity. One recent incident that underscores this complexity involves GlobalFoundries, a prominent player in the semiconductor industry and a spin-off from AMD, which found itself ensnared in regulatory challenges due to its dealings with a Chinese company.

GlobalFoundries stands as the third largest semiconductor foundry globally by revenue, a position it has achieved through diverse manufacturing for sectors including mobile technology, automotive industries, aerospace, and the burgeoning Internet of Things (IoT). As the industry has evolved, so too have the regulatory frameworks surrounding it, particularly those stemming from rising tensions between the United States and China. The significance of semiconductor production cannot be overstated; these chips are essential for everything from smart devices to defense technologies.

In the light of these geopolitical realities, the U.S. government has instituted strict controls over the export of semiconductor technology, especially to companies linked with the Chinese military, such as Semiconductor Manufacturing International Corporation (SMIC). GlobalFoundries’ recent disclosure of $17 million worth of shipments made to SJ Semiconductor—a company on the U.S. entity list—illustrates the precarious balance companies must strike between operational objectives and compliance with international regulations.

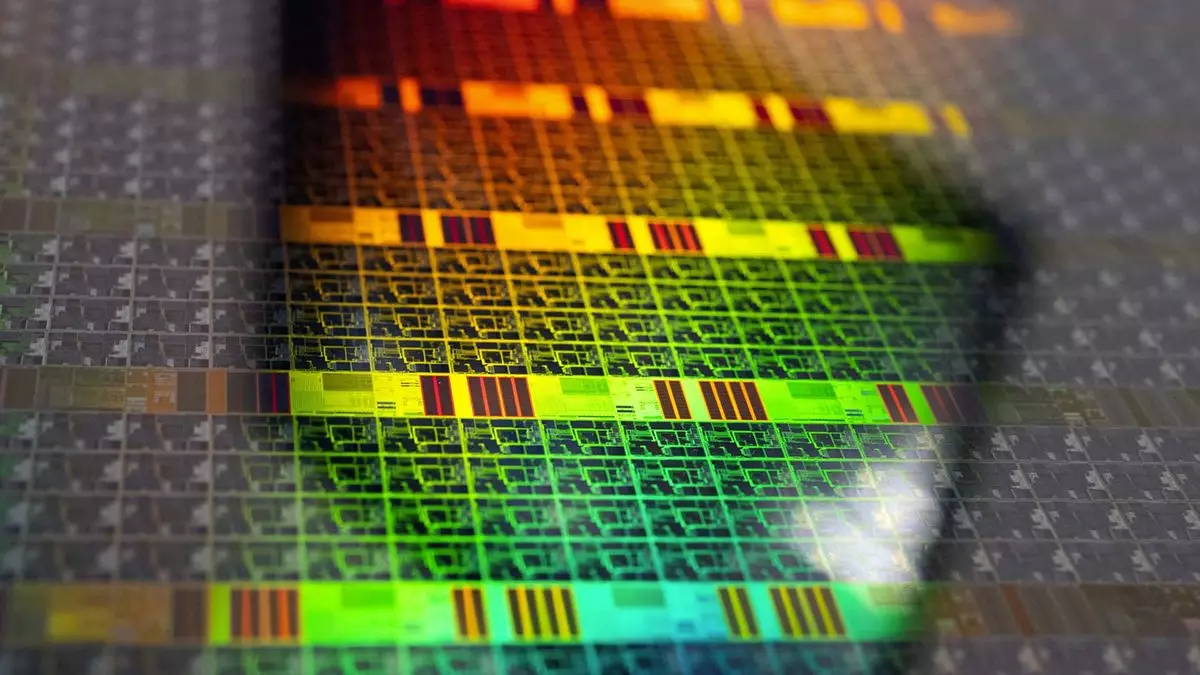

The Bureau of Industry and Security (BIS) confirmed that between February 2021 and October 2022, GlobalFoundries executed 74 shipments of semiconductor wafers to SJ Semiconductor. The ramifications were substantial, leading to a $500,000 fine for violating trade restrictions. However, this penalty appears to be relatively mild, especially when considering the financial capabilities of GlobalFoundries. In light of the unprecedented $1.5 billion awarded to the company through the CHIPS Act, this fine raises questions about the effectiveness of these regulatory measures.

Interestingly, GlobalFoundries self-reported the breach and cooperated with the investigation—a move that likely mitigated the financial consequences it faced. This opens up an intriguing dialogue about the U.S. government’s approach to regulatory enforcement; it seems to favor a model that encourages voluntary disclosures by potentially offering lesser penalties in exchange for cooperation. The message appears to be clear: admit your mistakes, and the consequences will be less severe.

GlobalFoundries is not the sole semiconductor manufacturer navigating these murky regulatory waters. TSMC, another heavyweight in chip manufacturing, recently identified that certain chips it produced may have inadvertently made their way into devices assembled by Huawei—a company similarly blacklisted by the U.S. government. This situation highlights a worrying trend across the semiconductor industry, where firms are increasingly scrutinizing their supply chains and client relationships to prevent breaches of regulatory requirements.

The fact that TSMC responded by pausing shipments to a problematic client and notifying both U.S. and Taiwanese authorities indicates a heightened state of awareness and caution within the industry. Such vigilance is essential, as the repercussions of non-compliance are increasingly severe, with the potential for damaged reputations and financial penalties.

As GlobalFoundries and TSMC navigate the turbulent waters of semiconductor regulations, the future remains uncertain. Will the U.S. government’s relatively lenient approach encourage more companies to come forward with self-reported breaches, or will it create a perception of impunity that invites riskier behavior? Moreover, with upcoming changes in administration and potential shifts in policy, the semiconductor landscape may experience significant changes.

The case of GlobalFoundries serves as a quintessential example of the challenges facing semiconductor manufacturers in today’s geopolitically charged environment. As these companies pivot to adapt, understanding the intricate balance between compliance, operational success, and ethical responsibility is paramount. The ongoing evolution of regulatory frameworks will undoubtedly shape the future trajectory of the semiconductor industry—and ultimately, influence global technological advancement.

Leave a Reply