The semiconductor industry is rife with excitement as Intel unveils its latest advancement, the Intel 18A chip production node. This announcement signifies a crucial milestone for Intel, but it also prompts contemplation regarding its implications for consumers and the broader market. Although the company’s promotional material exudes optimism, a deeper analysis reveals complexities that demand attention.

Intel has proclaimed its 18A process node as “ready,” eyeing its implementation for future products, particularly the Panther Lake laptop chip and the Nova Lake desktop CPU, both slated for late 2025 and early 2026 respectively. However, the gap between declaration and execution raises eyebrows. While Intel aims to initiate production runs in the first half of 2025, the absence of immediate, tangible products raises questions about the timeline and preparedness of this new technology. The juxtaposition of eagerness and caution highlights the intricate dance of innovation and practical application that defines the semiconductor sector.

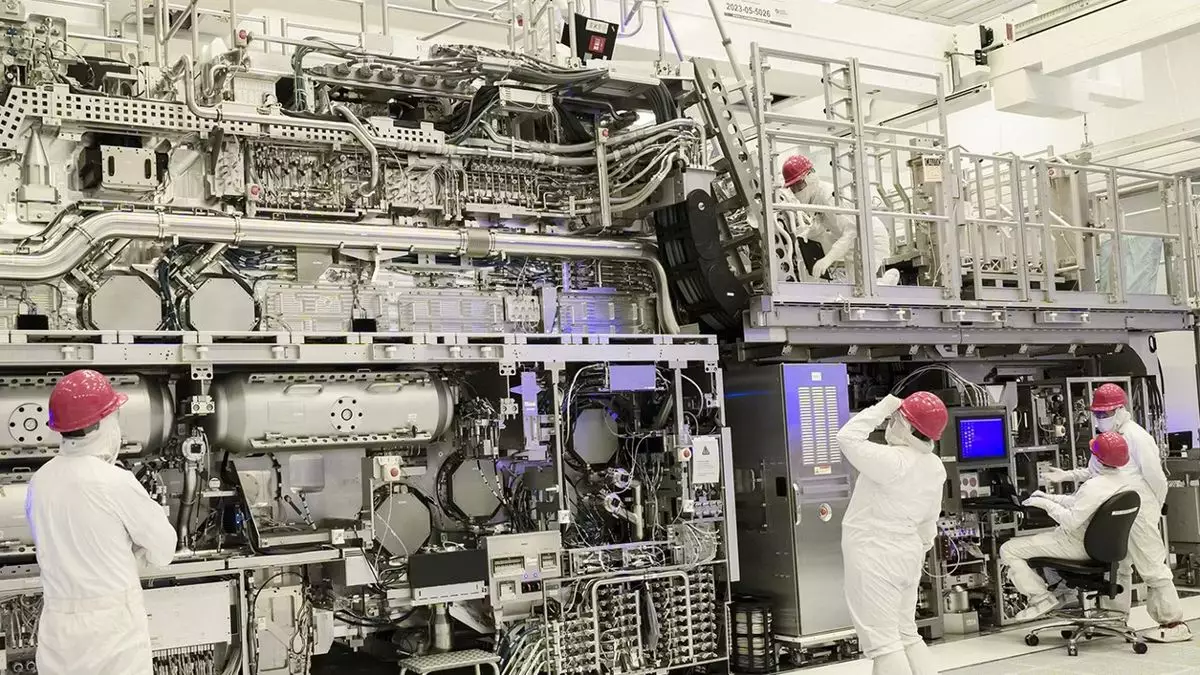

Unlike the flashy pre-launches witnessed from tech giants, Intel’s rollout seems heavily tailored towards courting potential partners for its burgeoning foundry business rather than a straightforward introduction of its products. The focus on developing relationships with external customers suggests a strategic pivot; Intel is keen to position itself as a viable alternative to the omnipotent Taiwanese manufacturer TSMC in a landscape where supply chains have grown increasingly frail.

Intel’s ambitious “five nodes in four years” strategy (dubbed 5N4Y) was articulated under the leadership of Pat Gelsinger, and on paper, it appeared to set the stage for a renaissance of innovation within the company. However, scrutinizing the individual nodes reveals a pattern of rebranding rather than groundbreaking advancements. For instance, Intel 7 was essentially an overhaul of an older technology, while Intel 4, despite being categorized as a new node, was primarily a repackaging of promised capabilities that had already seen delays.

Independent evaluations, therefore, suggest that only Intel 4 and Intel 18A can be regarded as genuinely innovative contributions to the technology spectrum. This raises broader concerns about the feasibility of Intel’s trajectory. If only two out of five proposed nodes are notably distinct, the credibility of the entire initiative diminishes. Such skepticism is amplified by the fact that if 18A is as transformative as Intel claims, the company’s seeming delay in releasing its first in-house chips on this node poses a significant contradiction.

Despite the challenges posed by ambitious timelines and promises that may or may not materialize, the specifications and advantages of 18A merit discussion. With claims of up to a 15% performance-per-watt enhancement and a 30% increase in chip density compared to its predecessor, Intel 3, this node appears to hold significant potential for revolutionizing chip manufacturing. Moreover, certain technical innovations, such as the introduction of RibbonFET technology and PowerVia delivery systems, suggest that Intel is aiming to pioneer configurations that could streamline performance and efficiency.

The theory behind PowerVia, which shifts power delivery connections from the front to the back of the chip, is intended to minimize interference and optimize energy efficiency. As TSMC makes its own advancements, particularly with its upcoming nodes, Intel must showcase how 18A can stack up when placed under market scrutiny.

Additionally, discussions about SRAM density reveal competitive parity with TSMC’s N2 node, suggesting that Intel could very well contend on both performance and efficiency grounds, provided they deliver on their promises.

The stakes are high for Intel, especially as Gelsinger has publicly stated that the company’s future is inextricably linked with the successful rollout of 18A. Any failure to meet expectations might not only hinder Intel’s market positioning but also complicate the broader landscape of semiconductor supply, potentially escalating costs for consumers. This could crystalize the current conundrum facing the tech world: a rapidly evolving industry that simultaneously grapples with stability and competition.

As anticipation builds around Intel 18A, data and product reality must synchronize to foster genuine excitement among consumers. Clarity and transparency in the rollout process will be paramount for rebuilding confidence not just in Intel but also in the larger semiconductor ecosystem. Only then can Intel hope to reclaim its position as a leader in chip manufacturing and innovation. The evolving saga of Intel’s 18A process node is one to watch; it holds the promise of technological advancement amid uncertainties that every tech enthusiast and consumer should closely monitor.

Leave a Reply