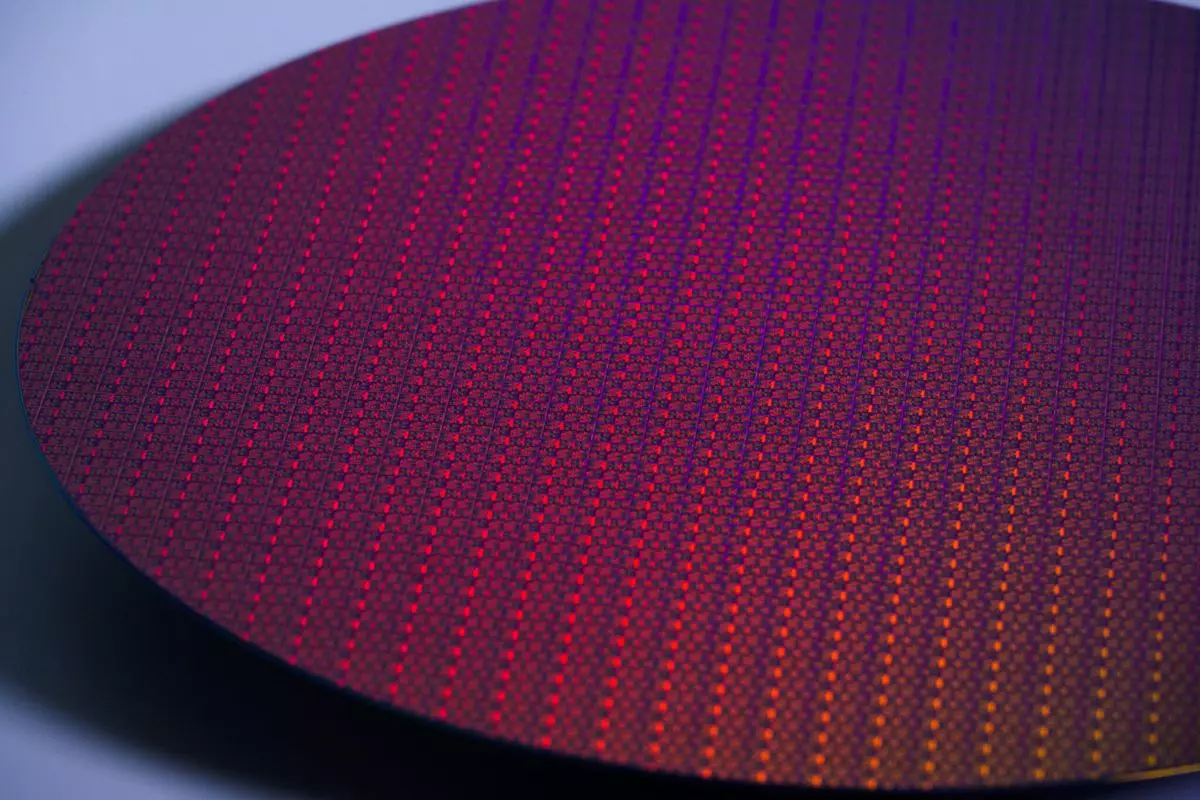

In the fast-paced world of semiconductor manufacturing, few names evoke as much intrigue as Intel. Recently, the discourse surrounding its foundry services has intensified, accentuated by the struggles the company has faced in the broader financial landscape. A revealing glimpse into Intel’s current strategy came from John Pitzer, the vice president of corporate planning and investor relations, during a recent technology conference. Pitzer indicated a significant shift in strategy: a decision to maintain a dependency on Taiwan Semiconductor Manufacturing Company (TSMC), with around 30% of their wafers still outsourced. This revelation contradicts earlier ambitions to eliminate that dependency entirely, which raises questions about the strategic roadmap Intel is forging amid its financial uncertainties.

It was only a year ago that the former CEO, Pat Gelsinger, expressed a firm desire to reduce reliance on TSMC from 30% to 20%. With Gelsinger now a figure of the past at Intel, the question remains—has the company’s internal leadership transitioned to a more collaborative strategy rather than an isolationist one? This new narrative reflects broader concerns of the firm’s position in a fiercely competitive market, suggesting the internal turmoil may have prompted a more pragmatic approach to partnerships, especially with a reliable supplier like TSMC.

Understanding the Fabric of Production Relationships

The decision to keep a portion of wafer production with TSMC is more than just a logistical choice—it symbolizes a complex interplay of competition and cooperation. Pitzer elaborated that the strategic involvement with TSMC fosters healthy competition, a duality that could potentially invigorate innovations in both foundry services. However, maintaining such partnerships also complicates Intel’s profit margins. TSMC’s influence on production costs signifies a shift in Intel’s foundational approach; moving forward, the balance of in-house manufacturing versus external partnerships will be pivotal.

Interestingly, Intel’s reliance on TSMC raises questions about the sustainability of its margin strategies. While external foundry services offer flexibility and scalability, the dependence on TSMC signifies a possibility of inflated production costs impacting overall profitability. This factor complicates the conversation regarding future pricing strategies for Intel’s products, presenting a delicate balance between the agility offered by outsourced production and the financial repercussions tied to it.

The Future of Intel’s Leadership and Strategic Vision

With interim executives like Dave Zinsner and Michelle Johnston Holthaus currently managing Intel, the search for a cohesive strategic direction appears muddled. The interim leadership is indicative of a transitional phase, one that likely places more emphasis on stabilizing the company rather than executing bold strategic shifts. With speculation swirling about who may take over at Intel’s helm, the nature of leadership will inevitably shape the future direction of Intel’s foundry business.

The chatter surrounding potential partnerships or acquisitions, including rumors that TSMC may eye Intel’s fabrication plants, further complicates the landscape. This development could signal an impending consolidation phase in the semiconductor industry, where power dynamics shift, and alliances become paramount in the quest for technological advancement. Whether TSMC or even companies like Broadcom will take concrete steps towards acquiring Intel’s capabilities could reshape technological resources and influence the competitive edge both companies hold in the market.

Market Adaptation in a Challenging Landscape

As Intel grapples with the implications of its foundry decisions, the reality of an evolving semiconductor landscape becomes increasingly evident. While reliance on TSMC serves immediate operational needs, it also brings to light the fragilities of dependency. As the industry evolves, Intel’s ability to pivot and adapt will be integral to its enduring success. The delicate balancing act of leveraging partnerships while potentially reclaiming autonomy in production capabilities presents an ongoing challenge.

Moreover, the delay in scaling back on TSMC partnerships resonates with a broader theme within the tech sector—organizational agility amidst operational challenges. Intel’s predicament serves as a case study in modern manufacturing realities, illustrating how even industry titans must navigate the complex web of supplier relationships and market pressures. As the semiconductor sector continues to innovate, it remains to be seen how Intel’s strategic decisions today will echo through the corridors of tech tomorrow.

Leave a Reply