Intel’s recent decision to divest 51% of its stake in Altera to Silver Lake marks a pivotal turn in the semiconductor giant’s strategy. Having previously acquired Altera for a staggering $16.7 billion in 2015, Intel’s move seems paradoxical, considering the valuation of Altera has now dropped to approximately $8.75 billion. However, this downsizing is more than a mere financial maneuver; it is a reflection of Intel’s intent to sharpen its focus on core business areas while still participating significantly in the strategic direction of Altera through its retained 49% stake.

This transaction indicates not just a financial realignment but also a psychological pivot in how Intel views its subsidiaries. By choosing to unload a majority share while keeping a minority interest, Intel retains a level of influence, indicating that it acknowledges the potential of FPGAs (Field Programmable Gate Arrays) as essential components in the evolving tech landscape. It seems apparent that Intel wants to foster a new culture for Altera, one that encourages agility and adaptability, moving away from the bureaucratic weight often associated with larger corporations.

Silver Lake: The Tech Investment Powerhouse

Silver Lake, a formidable name in private equity and tech investment, has a reputation steeped in profitability and proactive management. Known for its substantial investments in some of the most recognized names in the tech world — including Twitter and Airbnb — Silver Lake is not merely an investor but a strategic partner that enhances operational efficiency and market penetration. Its financial backing signifies confidence in Altera’s potential to innovate and thrive independently.

The fact that Silver Lake is spearheading this large-scale investment adds an aura of esteem around Altera. While the tech world often overlooks the robust capabilities of FPGAs, Silver Lake’s investment can serve to rejuvenate interest in customizable computing solutions. The partnership implies a uniquely positioned Altera that harnesses expertise from both Intel and Silver Lake, poised to ascend in an increasingly competitive market.

The Implications of Leadership Changes

Interestingly, this announcement comes on the heels of significant leadership changes at Altera. With Raghib Hussain stepping into the CEO role, the restructuring is emblematic of fresh vision and revitalized purpose. Hussain’s previous experience as president of Products and Technologies at Marvell sets a promising stage for innovation and technical prowess at Altera. It indicates that the firm is not just looking to maintain its relevance; it aims to position itself at the forefront of semiconductor technology.

This leadership transition correlates neatly with the sale, suggesting that change is not just financial but philosophical. Under this new leadership, Altera can transcend its previous identity as a division of Intel and morph into a frontrunner in semiconductor development with a newfound sense of independence. However, the real question is: how much influence will Intel still wield with its remaining share?

The Future of Specialized Chipmaking

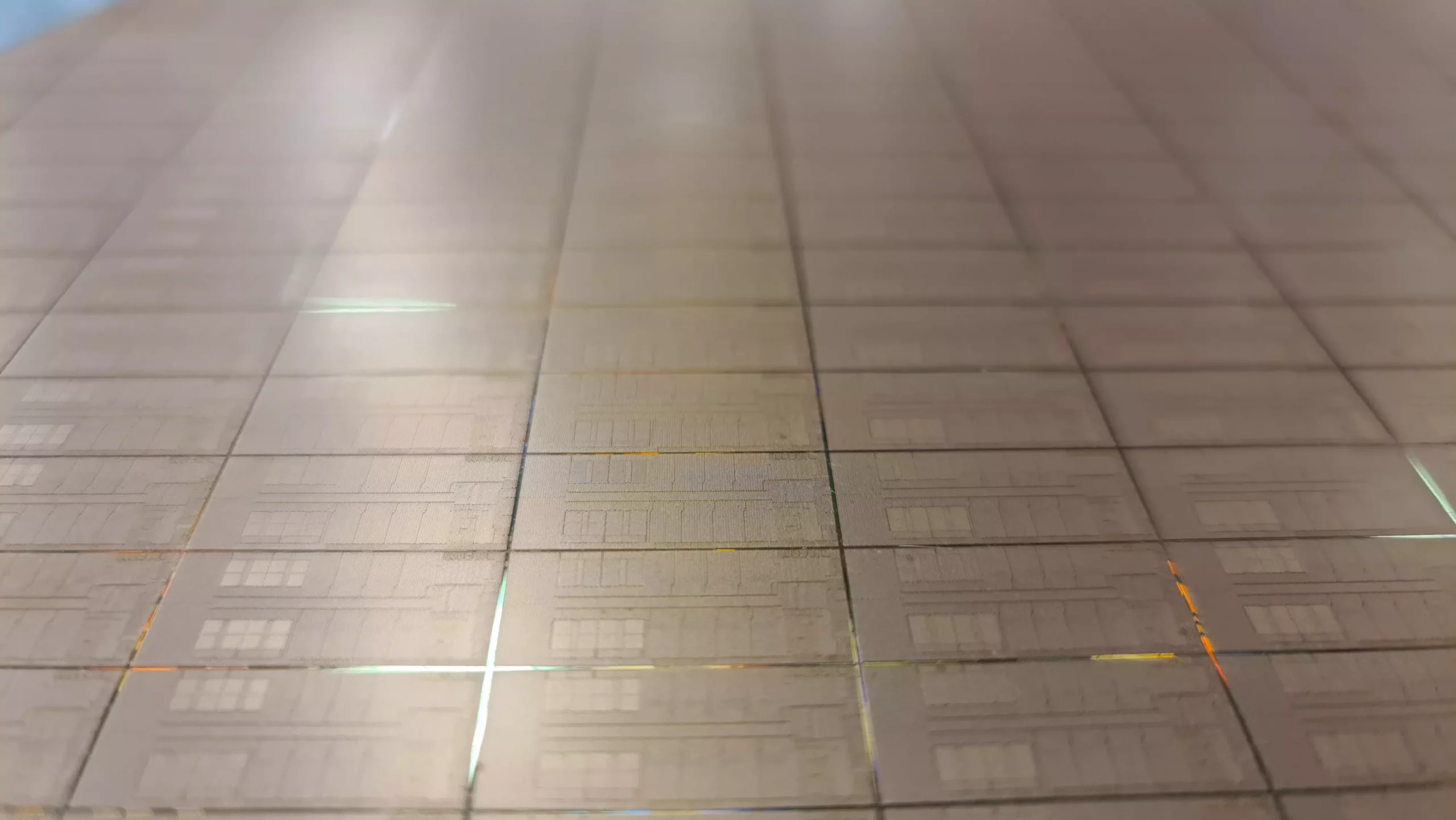

As technology continues to evolve rapidly, the need for specialized chip solutions becomes increasingly evident. Altera, with its focus on programmable logic devices, offers immense potential. It operates in a niche that combines flexibility with necessity, especially in industries such as telecommunications, automotive, and artificial intelligence. The strategic investment from Silver Lake not only underscores the financial value of this niche but potentially revitalizes the landscape for innovation in the semiconductor sector.

With Intel focusing on minimizing overlap and augmenting its core areas, the market can anticipate a wave of transformative advancements driven by firms like Altera. The collaboration between Silver Lake and Altera has the potential to catalyze innovations in FPGA technology and redefine how industries understand flexibility in chip design.

While the strategic divestment might raise eyebrows due to the financial implications, it speaks volumes about the direction in which Intel and Altera are heading. As Altera embarks on a new journey with Silver Lake’s backing and a refreshed leadership, the narrative is shifting — positioning Altera to not only survive but thrive as a leading player in the semiconductor domain. This move could serve as a blueprint for other tech giants contemplating similar paths in their operational strategies and market positioning.

Leave a Reply